On this page, we provide a detailed review of the Advanzia Mastercard Gold Credit Card. This Gold Credit Card is one of the best free credit cards in Germany and is highly recommended for newcomers, ex-pats, and international students to Germany. This article will provide you with details on how you can apply and make the best use of the credit card to your advantage.

On first glance, the home page of the website might not have an immediately recognizable brand name. But don’t be mistaken by the simple website. The Mastercard Gold credit card is provided by Advanzia Bank S.A.

Based in Luxembourg since 2005, Advanzia Bank SA has a banking license in Luxembourg and offers a free Advanzia credit card for residents in Germany, Austria, France, and Luxembourg. The bank has about 1.2 million active Advanzia bank credit card customers.

Free Mastercard Gold Credit Card

The credit card “Gebuhrenfrei Mastercard Gold,” which simply translated into German means “free of charge (or toll-free),” is not only free but also includes a lot of other advantages such as free foreign usage without any transaction charges, free cash withdrawal, free travel insurance, and up to 7-week interest-free credit period on purchases.

So what is the catch? Like all credit cards, it earns through interest rates on late payments. So, as long as you are financially prudent and stick to the repayment deadline, it is the best free credit card you can get. In addition, customers benefit from free travel insurance. Read below for more details on how to best use the credit card.

Who Can Apply?

The only requirement to apply is a residential address in Germany (Austria or France). Therefore, even if you can apply for this Advanzia credit card, irrespective of whether you are employed, self-employed, unemployed, or a student, This also includes ex-pats and foreign students even if you have not lived in Germany for a long time, you can apply for this credit card.

This makes it a perfect credit card for newcomers to Germany, including international students. Although the credit limit might not be very high at the beginning, you can quickly build your credit history and get a higher credit limit in a few months. Furthermore, you can enjoy all the benefits of being a Mastercard Gold card customer.

Click here to apply for free Advanzia Mastercard now

No PostIdent necessary

As long as you have an address in Germany and a personal bank account, you can get a credit card without the need for doing a PostIdent procedure.

Advanzia bank will send you the credit card to your German address which verifies your address, and you will have to pay your credit card bill using your bank account, which proves your identity. Therefore, it does not require a full identification process such as PostIdent. This is especially useful for citizens whose passport are not accepted for PostIdent (e.g., Indian Passport).

Features at a Glance:

- Zero Annual maintenance fees (Permanently free)

- Zero Foreign transaction fees – Free use Worldwide

- No PostIdent necessary

- Free cash withdrawals worldwide*

- Up to 7 weeks interest-free credit period

- Free request for a replacement card, PIN or card blocking

- Rental Car Discounts from Sixt and Alamo

- Free Comprehensive travel insurance included

- Personal customer service around the clock, seven days a week

- 5% cashback on booking travel tickets with free Mastercard Gold on their travel portal with a guaranteed lowest price

- Also for self-employed, students, pensioners and unemployed

Click here to apply for free Advanzia Mastercard now

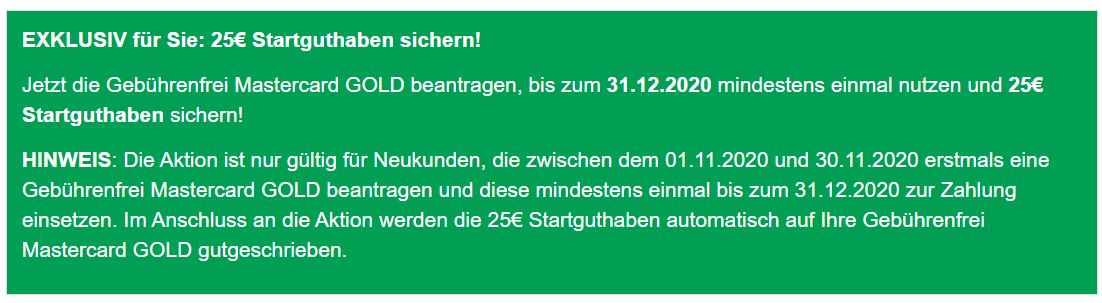

25€ Joining Bonus

Exclusive offer only for Banks-Germany.com!

We were able to obtain an exclusive deal, so this is only valid if you use one of the links from this website. The conditions for the promotion

- Apply only through the links Banks-Germany.com website

- Valid for new customers applying for the first time

- Apply between 2.Nov and 30. Nov 2020

- Activate and make the first transaction before 30.Dec 2020

The 25 € joining bonus will automatically be credited to your free Mastercard Gold card subsequent to the end of the promotion.

Click here to apply for free Advanzia Mastercard now

Detailed Costs

[table “15” not found /]Apply for Credit Card

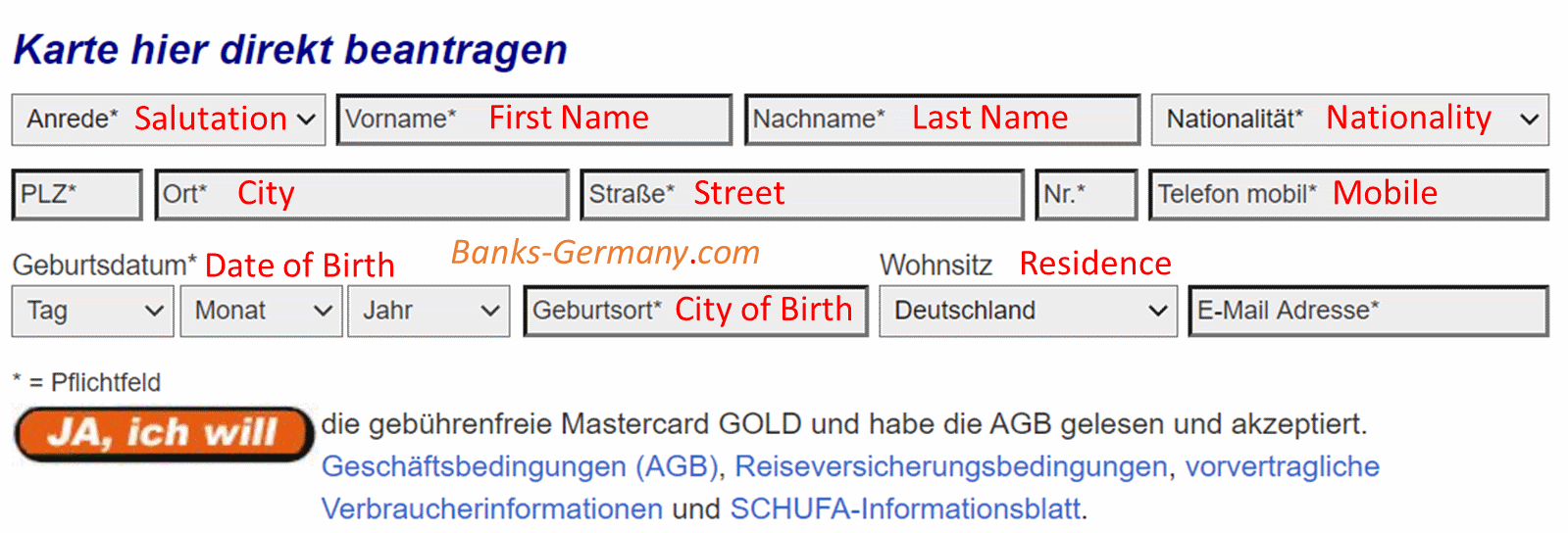

- Open the Online Application

Go to Home Page, using the link for joining bonus: (you will see the below information indicating Exclusive deal)

- Provide your personal details

Enter your personal details on the first page, including your Name, address, Nationality and Date of Birth. See below for the translations.

Once you enter your personal details, click on the button highlighted as “JA, ich will“

- Provide your details to Optimizing your Credit Limit

These details will be used to determine your credit card limit. So, provide correct information about your income and profession.

You can also leave this empty and a lower limit will be automatically allocated to you.

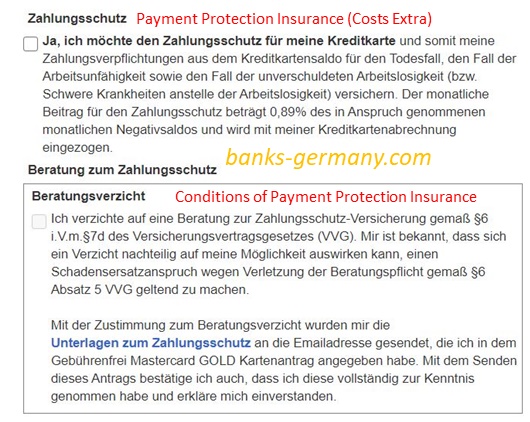

- Payment Protection Insurance – if needed

Select if you need insurance in case of inability of work or pay the bills. Read more about Payment Protection Insurance (Zahlungschutz).

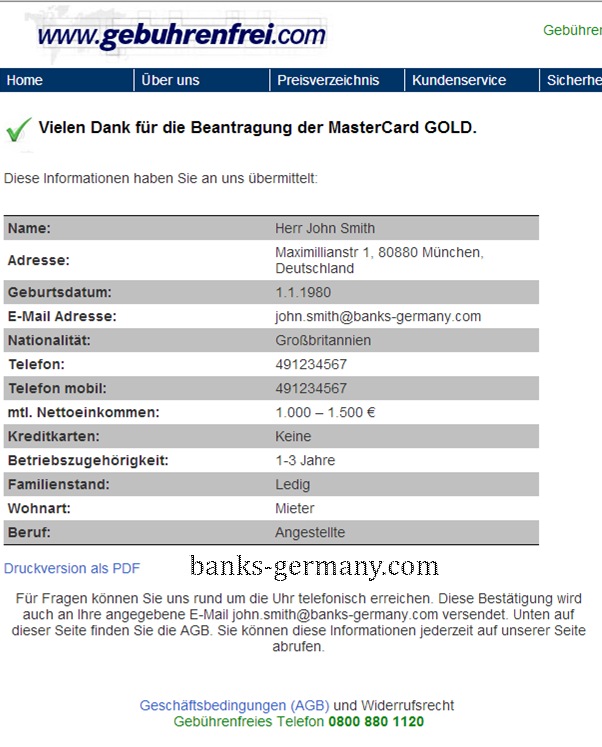

- Confirm Application and recieve confirmation email

After you finish the application process, you will receive a confirmation email

After application, your data and the credit score (e.g. Schufa, CEG) are checked, you will receive an confirmation email. - Receive and Activate (Gebuhrenfrei Mastercard Gold

On accepting your application, you will receive your credit card by post.

Activate your Credit Card

Within 2-3 weeks from the time of application, you will get a following:

- Free Mastercard Gold

- Activation card

- Postcard with credit Card Agreement

Sign the activation card and post it to Advanzia bank. The address is already mentioned on the postcard and the postage will be paid by Advanzia bank.

Once Advanzia bank receives your signed Activation Card, your credit card will be activated and you will get a confirmation e-mail. Now, you can use the Toll-Free Mastercard Gold within your personal credit limit.

You will shortly receive the PIN separately by post which you can use to withdraw from an ATM. The letter will also indicate your personal credit limit approved for you.

Using the Credit card

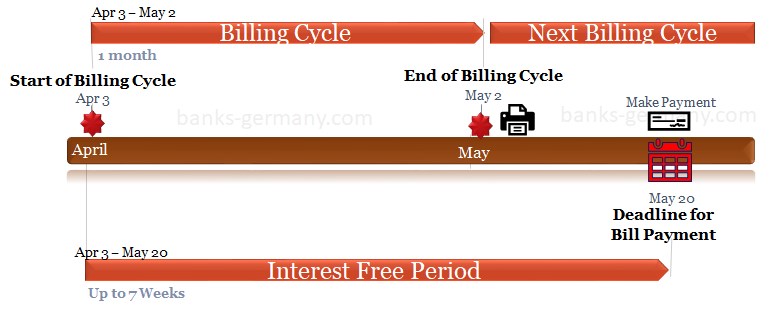

Keep a track of your billing cycles and pay the bills on time. We have provided an easy illustration to explain the billing cycles and when interest payments are charged.

Billing Cycle Explained

First, you should know your billing cycle of Advanzia Mastercard Gold credit card starts from 3rd of each month and ends the 2nd of the next month, and the deadline to pay each billing cycle month is the 20th of next month, and so on.

So as an example, the billing cycle starts on 3.April to 2.May, the credit card statement is sent by email on the 3 May, and the deadline for payment is 20 May.

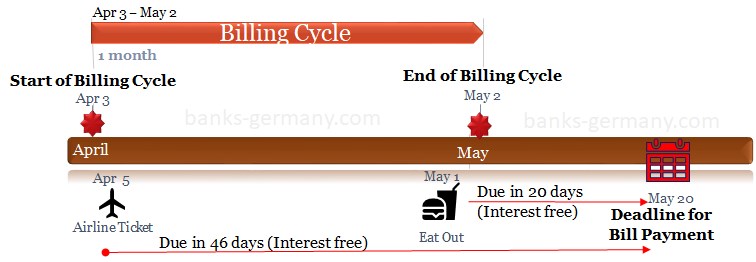

Interest-Free time

When making a purchase, such as an airline ticket or eating out during the billing cycle, it is included in the statement and due on the 20th of the next month. So depending on when you make your card purchase, you will have between 20 days and 47 days interest-free period to make the payment as explained below.

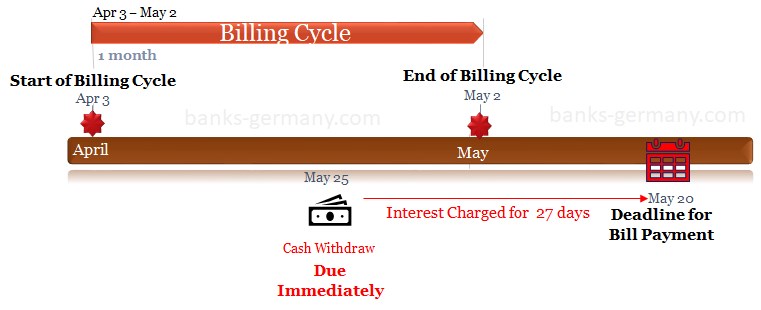

Cash Withdrawal Interest

Warning: It is important to note that Cash Withdrawals using Advanzia Mastercard Gold are not treated as purchases and cash withdrawal using credit cards are due immediately. So, the interest on cash withdrawal will be applicable from the first day as shown below:

Pay your Credit Card Bills on Time

The Credit Card Bill is generated on the 3rd of each month and you will have to pay by the deadline of 20th of each month. You can pay your credit card bill using manual bank transfer to the bank account mentioned in your statement.

Warning:

- You will get your credit card bill by email. Also, check your online account.

- You will have to actively make a transfer each month from your bank account to the Advanzia Credit Card account.

- It is not automatically deducted from your bank account. So, do not forget to make a transfer on time. To be safe, make an online transfer two working days before the deadline to avoid any interest charges.

- You cannot have a credit balance (i.e., deposit more money than you have to pay). That means you cannot keep your account in a positive with a credit balance on your credit card account. Deposits that exceed the card balance may be rejected. But you can make partial payments during the course of the period.

Therefore, be a prudent user of the credit card and benefit from all the features of the free Mastercard Gold credit card.

Payment Protection Insurance

For an additional cost (0.89% monthly bill), you can insure in the event of incapacity for work, involuntary unemployment (full-time employees and self-employed), serious illness (not full-time employees or non-self-employed) and in the event of death.

How does payment protection work?

If you are diagnosed with a serious illness or event of death, any credit card balance up to an amount of 10,000 euros will be paid off.

In case of incapacity for work or involuntary unemployment, you will receive 10% of your previous bill paid (up to max of EUR 1,000 pm), each month, until you are healthy again or have found a new job (up to a max of 12 months).

How much does payment protection cost?

Payment protection monthly insurance premium is 0.89% of the negative balance on your credit card used in the billing period. If your credit card account does not show a negative balance, no insurance premium is due.

Duration and terminating the Insurace premium

The start of insurance is documented in your insurance confirmation, which you received from Advanzia Bank SA.

The contract term is only one month and is automatically extended each month.

You can cancel the payment protection insurance with a notice period of 2 weeks before the next billing of your credit card.

FAQ on Free Mastercard Gold

Your personal credit limit will be provided for the first time together with your PIN. Also, this will be displayed on each of the credit card statements.

Your credit limit is based on your personal information that you specified in the request and set (if resident in Germany) based on the data provided by the Schufa / CEG or other agencies.

If there are any changes to your personal information, please inform Advanzia Bank in writing.

The credit limit may be somewhat lower at the beginning until the bank checks the payment pattern and customer relationship. However, after a few months if regular payments have been noted your credit limit may be increased.

Another reason for a low credit limit may be missing or incomplete information during the application process. If you have entered incomplete data and incorrect personal data (occupational group, marital status, etc.), you can update Advanzia Bank by e-mail or letter to update your data.

You can make a maximum of 5 ATMs withdrawals within your credit limit or up to a maximum of € 1,000 a day.

If you want to reduce your credit limit for safety or personal reasons, you can contact Advanzia Bank in writing (letter, e-mail) to adjust the credit limit.

You will receive your Credit card bill by e-mail on the 3rd of each month. If you have not received then check your spam messages. Alternatively, you can login to the online account anytime and also check your credit card statement online.

No, Advanzia bank does not allow automatic debit authorization of your credit card from your bank account. Since they offer the option of partial payments, Advanzia bank does not collect the invoice amount by direct debit from your account.

This keeps you flexible and allows you to decide for yourself how much you want to transfer each month. But always remember to pay your credit card bill on time.

You will have to make a manual transfer each month from your bank account to your credit card account. The IBAN number where you should transfer is mentioned on your credit card bill.

It is like a regular money transfer to a bank account. Just enter the IBAN details of Advanzia bank (personal for your credit card account) and transfer the due amount before the 20th of the month.

It is important that you transfer the money from your own bank account. If you do not use your own bank account, you will have to make a full identification, eg by means of the PostIdent procedure, due to the Luxembourg anti-money laundering regulations.

If you have sent us a copy of the ID card and at least one deposit has been made from your own account, the further transfers can also be made from a third party account.

The PostIdent procedure applies if you do not have your own account to use for the transfer.

Yes, you can make deposits in between and before the due date, either in full or in part.

This is especially useful if you have a lower credit limit. By making a payment before time, you can make more purchases using your credit card. For example, your credit limit is €1000, and you buy a flight ticket for €800. You can immediately make the payment of €800 so that you can continue to utilize the full credit limit again within the same month.

If you have paid at least 50% of the total travel costs with an approved transport company with the Free Mastercard Gold and all other requirements are met by the insurance conditions shall automatically apply the protection of our free travel insurance. The cardholder and up to 3 other fellow passengers are insured for a period from 2 to 90 days.

The insurance benefits of the free Mastercard Gold include the following main features:

– Up to 3 other passengers

– Valid from 2 to 90 days

– Travel Liability Insurance: per incident up to € 350,000

– Foreign Travel Health Insurance: up to € 1,000,000 including dental expenses

– Travel Accident Insurance: Up to € 40,000

– Travel cancellation insurance: deductible of € 100

– Luggage Insurance: up to € 2,500 for one person, up to € 3,000 total for a journey of several persons

– Travel Accident Insurance

– Deductible for treatment costs in the EU after an accident: € 185

The insurance is valid for the credit card holder and their partners, children under 23 years who are resident at the same address or, if they live at their place of study, are supported financially by the cardholder. The insurance is also valid for your children (also adopted or foster children), although they live at a different address, but have previously lived with the cardholder.

The insurance is also valid for up to 3 passengers travelling together. If the number of passengers is greater than 3, the youngest three are insured. This insurance also covers the passengers if they have the same itinerary, duration and stops similar to the cardholder.

If family members and travelling companions accompany the cardholder on the trip, so the insurance company first applies to the family members.

Age restriction:

Over 67 years – reduced the maximum sum insured for accident insurance

Over 70 years – reduced maximum duration to 21 days

Over 75 years – No cancellation insurance

Over 75 years – No travel medical insurance

Gold Mastercard is free of charge both for purchases and for cash withdrawals. In some cases, other banks ATM’S charge a small processing fee for using a foreign card.

This fee may amount to EUR 2-5 per-cash transaction. In these cases, Advanzia Bank SA does not refund these fees since these processing fees are not incurred by them or sent to them.

Warning: Even though it is free to withdraw, the interest is charged from the first day.

The machines operated by banks are obligated to inform the cardholder of the handling fee at the ATM, and the cardholder must agree to this charge BEFORE the cash withdrawal – otherwise, this transaction does not take place. If you notice that the banks require such processing fees, we suggest you try another bank ATM’s.

In unavoidable circumstances, you can try to keep the number of cash withdrawals low. These fees are charged per transaction/cash withdrawal and this regardless of the draw. Thus, it is advisable to withdraw more money per cash withdrawal and therefore less often to go to the ATM.

You may revoke your contractual declaration within 14 days in writing without giving reasons. The revocation period begins from the rate of receipt of your card (which is considered as the completion of the contract).

The revocation request must be sent to, Advanzia Bank SA, PO Box 4108, D-54231 Trier.

You can cancel the Card at any time.

The contract may be terminated by you at any time without notice and without giving reasons.

If you wish to cancel your credit card agreement, please send a message (e-mail, letter) concerning the termination of your wish or send us your credit card (cut) with a covering note back.

You will receive a written confirmation of the cancellation from Advanzia Bank SA.

Sixt Rent a Car: You get up to 10% discount on your Sixt Rent a Car Booking worldwide when paying with if you pay with your Free Mastercard Gold. The discount also applies to the cheap internet tariffs.

Alamo: You get up to 20% off at over 330 Alamo locations in the U.S. and Canada when booking with your Free Mastercard Gold.

You can access the My Advanzia portal gebührenfrei login

https://mein.gebuhrenfrei.com/

By registering for My Advanzia mein.gebuhrenfrei.com you have access to additional services free of charge:

– Real-time account balance and the current, available credit line.

– Access to current and past billing information on your credit card.

– Check and change your personal contact details.

– Personalised offers and other news.

By Telephone (24/7)

0800 880 1120 – free of charge from the German landline network

+49 (0) 345 – 21 97 30 30 – from other countries or mobile networks

Advanzia Gebuhrenfrei Email Contact: service@gebuhrenfrei.com

When you receive the free Mastercard GOLD by post, it has not yet been activated for security reasons. Together with the credit card, you will get an activation card letter, which you should sign and return to the bank.

As soon as the bank receives your signed activation card, your credit card is activated and ready for use. You will get an email informing you that the card is activated.

For an additional cost, you can insure in the event of incapacity for work, involuntary unemployment (full-time employees and self-employed), serious illness (not full-time employees or non-self-employed) and in the event of death. Read more

Payment protection monthly insurance premium is 0.89% of the negative balance on your credit card used in the billing period.

Read more

The contract term is only one month and automatically extended each month. You can cancel the payment protection insurance with a notice period of 2 weeks before the next billing of your credit card. Read more

You can apply for this during applying for the credit card.

If you already have the Credit card and want to take the additional payment protection insurance, contact the customer service by phone or email. Read more

The Advanzia Mastercard additional payment protection (Zahlungsschutz) ensures

– your card balance (up to €10k) is paid off in case of serious illness or death, or

– In case of incapacity for work or involuntary unemployment, you will receive 10% of your previous bill paid (up to a max of EUR 1,000 pm), each month, until you are healthy again or have found a new job (up to a max of 12 months). Read more

Advanzia Gebuhrenfrei Credit Card uses transparent Mastercard currency conversion rate, which you can check on the website (https://www.travelprepaid.mastercard.com/rates/)

Online casino test

Es gibt viele Gründe, die Bewertung auf online casino test zu lesen. Dies gibt Ihnen nicht nur Einblick in das Glücksspiel anderer Leute, sondern spart Ihnen auch Zeit und Geld. Nachfolgend sind einige der Qualitäten einer guten Casino-Rezension aufgeführt. Lesen Sie sie, um das beste Casino für Sie zu finden. Das erste, worauf Sie achten sollten, ist die Benutzeroberfläche. Wenn es ungeschickt ist, werden Sie viel Zeit damit verbringen, herauszufinden, wie man etwas macht. Online-Glücksspiele sollen entspannend sein und Spaß machen, aber wenn die Benutzeroberfläche klobig ist, werden Sie es auch nicht sein.

Hello sir my name is jan hakim.i am living here in worms germany.I am working as a house keeper in city hilton hotel Mainz.i want to apply for gold credit cart of your bank .how I get this credit card.the form on internet is in German language .plz kindly inform me how I apply and how I get the card of limit between 3000 to 5000 euro.i am also working with nebulingen kurire here in worms.plz inform me if I am elegebil for this card.

Thanks and reguards

Please I have 2000 limit can I withdraw that at once on th ATM ?

You can withdraw only €1000 per day. Beware you have to pay interest on the money from day 1, no billing cycle here.

What do you mean no billing circle for a withdrawal of 1-2k euro?

But you said we would have at least 20 days to pay any amount.

There is a difference between using the card for cash withdrawal and using the card for purchases.

See the billing cycle illustration for CASH WITHDRAWAL INTEREST.

Pls how do I start payment at first 1000k withdraw?

I don‘t think you‘re eligible for 3000-5000€ if you‘re only a house keeper. My friend is working as a nurse and her credit limit is only 3000€ and she’s German. My credit Limit is 7,500€, I have a full time job and working in a pharmaceutical company.

hello,

i have toll free creditkatre but, i don`t know how deposit payment in my creditkarte

i have no any bank account so pls help me for this my problems

please say me in details what i do?

I want to apply gold Credit card what is the process for it.

I’m really loving the free travel insurance. Thinking of signing up for this reason alone. But it’s a toss up between this one and the SunnyCard.

I thought I replied to this, but my comment seems to have been lost.

I personally have this card and can recommend it. The free travel insurance is great, specially for the price (free). I also like the zero foreign transaction fees since I buy on Ebay (pay in US$) and Amazon UK and do not have to pay transaction fees (it usually is 1.5% by other cards).

I replied to the SunnyCard in that page. It is good, but I suppose not for the purpose you are looking for.

Also, what a nice explanation of how to sign up. Sometimes us expats need the hand holding through German forms. 🙂

Thanks, this was exactly why I started this website as I had the same problems when I first came here. Thanks for finding time to visit the website.

Ms. Canadian Expat, how has your experience been with this card, if you got one?

I like this banks

I need a goldn card

In a word I am very very happy with this free MasterCard Gold credit card …….!!!!!

It is a great financial friend for a student…..!!!

I just want to use my gold card for purchase only by signing instead of ATM cash taking. As a matter of safety, can stop the Bank from issuing the PIN to me?

Does this card work for any kind of online transactions, such as flight bookings, hotel reservations, etc?

Hello ich bin bhavana

How can I check my account balance online

How do you pay back ? can you set automatic payment for the end of the Credit-used month + 1.

For eg.

If i use the credit card … for amount x Eurs (where x is within the credit limit ) in month of Jan

then can have the payment done to the card from my checking account (DE based) by end of Feb (Jan + 1 months).

This automatic rule needs to set so the payment back is never missed. which is well under the 7 weeks charge possibility for the card.

Hope i could ask a clear Q 🙂

I have had this card for about 3 years.

To be honest, the system works very slow. For example, you will not receive any SMS if the cards was used; of course you can check your account from internet, but unfortunately, due to the “slow” system, you can only see your payments days later.

Additionally, if you transfer e.g. 100Euros to the card, and please remember DO NOT withdraw money withins 2 to 3 days. Coz’ their “supper” system will take days to confirm it. If you withdraw money right after the transfer, the system will record you borrow money from them, then you will be changed……

AND, if you ague with them, where is it written that I did the transfer in seconds, but due to your slow system needs days to “confirm”, I have to be changed. the service guy will tell you, it is somewhere in their home page. If you ask where, they will tell you unfortunately you need to find it BY YOURSELF!!!!!

If you can guarantee you will have no trouble for years, then it is worth a try of this free credit.

BR

YL

hello..its possible can i ask credit gold master card,i would like to be one of the best credit card….please let me know how can i get credit gold master card…im living in belgium and working also…

I want get a master card

IS this credit card safe ???

My gebührenfrei Mastercard have been sent to me and sign a signature since two weeks now have not yet receive activation code why

Hello,

Thank you for the detailed information. I have a question about the payback system. I see that until 7 weeks of its interest free. I want to know what is the time limit to repay with the interest. Is there any possibility of paying a minimum amount every month and extending for a few months?

Where and how do you pay the balance if you do not have an account with advanzia?

pls how i can make my mastercard to work by internet ?

Can I get a PPI Refund when i finish my payment and terminate the card?

I have recieved my pin code but i cannot withdraw it always say invalid card

Hello! I just received my mastercard but still waiting for the PIN to be sent. I am really excited to use my card but somehow afraid too because i don’t have any idea how can i settle and pay my credit since i don’t have a bank account with Advanzia Bank which is the partner of the gebuhrenfrei card that i have just received. Can you please explain to me how can i settle my credit? Do i need to go to a payment center?

Can i convert my purchase to EMI for 3 months or 6 Months? What will be the rate of interest in that case.

EMI – Equated Monthly instalments? If I understand correctly, you want to convert your purchase into a loan with a favourable interest rate which is less than the credit card rate?

No, this card does not provide it. You can pay any amount above the minimum till you finish paying the credit card, but the interest rate will be the same.

You can look at Easycredit card where you can convert your purchase in to loan: https://banks-germany.com/easycredit-credit-card-with-integrated-loan-option

Also Genial card which currently has an offer of 3 months interest free: https://banks-germany.com/goto/genialcard

But, these have high Schufa score requirement since it is similar to getting a loan

Hi there.. I Have a question I live in Germany now and will travel to Spain and other countries for 6 to 9 months. I’m wondering how I pay back money to Advanzia mastercard? Is that possible I transfer money from someone eles account or I need to my bank account over these countries?

As long as you have a bank account with IBAN (any EU bank), you can transfer from anywhere using SEPA. So if you have a German bank account and having an extended holiday in Spain, you can still use your German account to pay your credit card bills. You do not need to open new bank accounts in Spain.

It is important that you transfer the money from your own account due to money laundering laws. Otherwise, you will have to do a full identification such as PostIdent

But, if you have sent a copy of the ID card and at least one deposit has been made from your own account, the further transfers can also be made from a third party account.

Is this credit card provides free CDW and theft protection on car rental contracts?

Hallo.i have questions and i need your help plz

E.g i have a credit for 1500euro.

For how long do i have to pay

How much do i have to pay ?

Thank you

Hi. I registered for the gold credit card but realised later there has been some typographic error due to the malfunctioning of my keypad. What can I do?

Hi could you say for the Internet security or miss use of the card for example I live with other flatmates and if they pick my card and use it how can I protect my self against it , other thing how am I covered against fraud usage , I have not seen much about it please ?

What about deposit with, for example, car rentals?

Let´s say I need to keep a deposit of 500€ for one week, will the card “understand it´s a deposit or will it ask me for money? If it asks me for money, should I pay or just wait for the deposit to be canceled? And if I pay the deposit, how can I get back the money once the deposit is canceled?

It would be nice if anyone can clarify me that, given this will be the main use of this card.

I can do now everything with PayPal, except for this damn deposits. 🙁

Hi,

Can I transfer my balance to a balance transfer credit card and pay my debt this way?

I was asked to send by post signed activation certificate however i have not received the activation certificate. I was mailed that 200 euros limit have been approved.

Please, i want to know whether the activation certificate is sent to one’s email address or to the hose mailbox. Kindly respond urgently to me question.Thanks.

Hello sir i applied for Mastercard gold and i have received it, but i can’t activate it i wait for pin and activation i never get please help me

I have a question about free travel insurance.

We booked a non-refundable return flight ticket for our family (3 persons) holiday using Advanzia Master Gold Card. However, hotel booking was made not by credit card, which can be cancelled against a cancellation fee of about 100 €.

We unfortunately cannot make this travel due to sickness of my wife.

Can we claim also the hotel cancellation fee (although not paid by Advanzia card) along with non-refundable flight tickets from Advanzia travel insurance?

Many thanks for your help in advance.

Hello,

I have this card since one year, lately I noticed they take at the end of the bill a raletivelly big amount of money, I tried to calculate exactly how is it calculated but I still didnt figure it out.

At the end of each bill two lines appear:

ZAHLUNGSABSICHERUNG and SOLLZINSEN,

can you tell please how is it calculated?

Thank you in advance

I have been paying regularly every month without a delay. Please how then can my credit limit be increased? What should I do for it to be increased? I need money please. Thanks.

Assuming that I have borrowed 3000 Euro in the current month now the question of interest reagrding the payback system would be that can I do the payback in installments and not the whole amount? meaning that each month I pay a portion of the borrowed money lets say 500 per monthe for 6 months in row knowing the fact that I also have to considere the interest rate

1. How do you transfer online. From my Bank it appears a international transfer and transfer fees are high. Any recommendations

2. You should add a section how to close this card.

Thanks for the write up.It really helps for non-Deutsch speaking people

How long will it takes before i can get the pin?

Will i have to pay interest without using the credit card?

You only pay if you have due. If you did not use your card, there are no fees.

Please I want to know if my credit limit is 800 euro and I decide to withdraw the cash from atm,how much can I pay monthly and how long?

You will have to pay interest from the first day. For cash withdrawal, there is no billing cycle. So the longer you take to pay, the more interest you pay.

For example I borrowed 1000 euro and I wish to pay

back every month installment of 100euro,

Please how much should be the interest of this

1000euro thin the end of ten months?

I will really appreciate your kind response if its helpful

Thank you!

Are this cards free?

If they are …..I want to buy one?

Yes, it is free.

You can apply by going through the detailed steps explained above.

Please how can someone apply for the travel insurance

You don’t need to apply separately. Travel insurance is provided automatically with the card.

So, if you pay for your ticket using the credit card, the travel insurance will apply for the purchase.

Hello good morning I lives in Germany and I apply for master card but unfortunately I can’t use it to buy things online now please can I no why

I don’t no why I can’t use it to buy things on Ali Express it is not working for me here please I want to no if I have to go through any process first

is there ay option for monthly payment of my total bill,

if so what is the interest rate?

icloud Ferry

Activate. my creditcard

Julia Vernov

And sending speed main to my cards

Never include your card information so others can see it. We deleted them on your post.

We recommend you get another card as you already provided them and it could be misused by others.

Please,I would like to know if I can have 2 credit cards from advanzia bank

Thanks

What is PAYMENT SECURITY (ZAHLUNGSABSICHERUNG) in the billing invoice. Why is that included in the bill?

This fee relates to payment protection insurance (Zahlungsschutz), which is explained in the article above. You can cancel this insurance each month.

Varinder.cumber1@gmail.com

An asylum seeker applied for this credit and was given € 1,600 and he has being making payments since last year without defaulting. However, his asylum case was rejected and hHe has been ask to leave the country ( Germany). What must he do concerning his remaining loan of € 1, 350.

Lui good day, pls i just Received my master Card and I have sign the paper and resend it back to then pls how to used advanzai online on My phone, Because i have Try to login,, it not Possible,, thank you

Hello, please I have paid the 1000 euro limit,

but my credit limit has not yet been added.

My doubt is basic, can I transfer money against dues from Estonia bank?

Is that considered from the bank, as it falls in EU?

Hello,

I have a question regarding paying partial payments after the billing cycle:

is this permitted? if yes, how much interest is accumulated per month on remaining amount to be paid?

thank you

I have send the return confirmation letter to activate my card. I just dropped it in yellow Deutsche Post Briefkasten without buying stamp. Did i made it right?

Hello,

I would like to know if I ask for my credit limit to be increased to up to €15000 .

Thanks

Sohbet ve chat yapmanızı kolay ve güvenli hale getiren sohbet odaları, sorunsuz ve kesintisiz mobil sohbet siteleri ile arkadaşlık ve yeni kişilerle tanışma imkanı.

Is it possible to pay the credit card bills using my debit cards?

Bună seara

Daca nu mai știu pinul de la card cum trebuie sa procedez pentru al recupera?

Hi,

I have only lived in Germany for 6 months and my residence card valid until Oct 2023. I tried applying for other CC but they require a minimum residence permit of 24 months. Does this one have similar requirement on the residency permit as well? thank you!

Hi,

Can this card be used in Turkey?

I need this to help me I we pay back