SEPA stands for “Single Euro Payment Area” and is the desired mode of payment or transfer within Europe. Introduced in 2008, SEPA allows you can make any cross-border transfer to a bank account for the same cost and time as a local transfer.

National and cross-border SEPA payments

Since SEPA allows bank customers to make national or cross-border transfer European payments (including Iceland, Switzerland, Norway and Liechtenstein) in the same way. So any EU-wide SEPA transfer is processed within three working days.

In short, using the SEPA Transfer, all transfers within the EU will be the same as a domestic transfers.

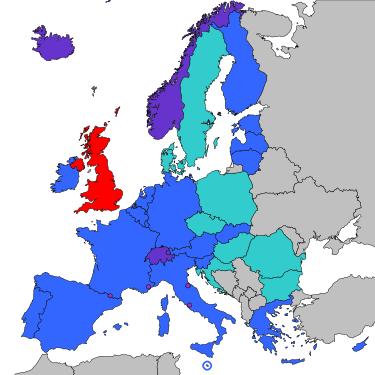

SEPA Countries

SEPA comprises the Eurozone, countries within the EU and a few other countries that also support EUR bank transfers.

How to make a SEPA Transfer?

You can either do this using online transfer or using physical forms at the bank.

Details necessary for SEPA transfer: To make a SEPA transfer, you need the following details of the beneficiary (person to whom you are making the transfer):

- IBAN and BIC

- Name of the Beneficiary

- Reference number (Optional)

IBAN and BIC

International Bank Account Number (IBAN) and Bank Identifier Code (BIC) have now more or less replaced the old account number (Kontonummer) and Bank code (BLZ). It is very important to enter the IBAN number correctly.

The structure of IBAN and BIC follows very clear rules. Here’s a quick overview:

- IBAN: The international bank account number is significantly longer, up to 34 digits. It is composed of the country code for Germany (DE), a two digit test and – together with the eight points of the previous bank code and the 10-digit account number – in the Federal Republic. The IBAN looks like this: DE 12 12345678 1234567890th

- BIC: the Bank Identifier Code is a comprehensive eight to eleven digits number-letter combination. The first four digits represent the bank code (BBBB), followed by the two-letter country code (CC), a two-digit coding of location (LL) and three points for the branch or department (bbb). This results in the following pattern: BBBCCLLbbb. To cite just one example: The BIC of Postbank is PBNKDEFF.

2. Name of the Beneficiary

Name of the person to whom you are transferring. This is normally not checked

3. Reference

The reference (sometimes called SEPA Reference) is for the recipient to identify the transfer. So, if you are paying a bill, the reference number is normally mentioned on the invoice (mostly invoice number). The reference can be a combination of numbers or text.

This will also be listed on your account statement, so if you are transferring to family or friends, you are free to enter a text which you can use to identify the purpose (e.g., dinner, rent etc.).

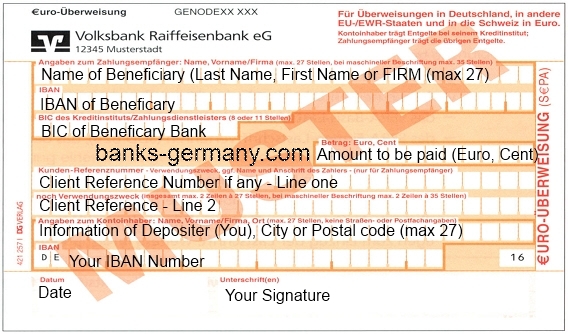

SEPA form English translated

You can also use the bank form for such a transfer. A SEPA transfer form translated into English is provided below for reference.

Note: It normally costs to transfer using a physical bank transfer form.

SEPA Direct Debit Order

SEPA Direct Debit is a payment method that allows a business or organization to collect funds from a customer’s bank account. It is used for recurring payments, such as monthly subscriptions or utility bills.

To set up a SEPA Direct Debit, the customer must provide the business or organization with a signed SEPA Direct Debit Mandate. This mandate authorizes the business to collect funds from the customer’s bank account on a regular basis. It specifies the maximum amount that can be collected and the frequency of the collections.

When a SEPA Direct Debit payment is due, the business or organization initiates the payment by sending a request to the customer’s bank. The bank then debits the customer’s account and transfers the funds to the business or organization.

SEPA Direct Debit payments are considered to be secure and reliable and offer certain protections for customers, such as the right to dispute a payment and receive a refund if the payment was unauthorized or made in error

FAQ about SEPA Transfer

SEPA (Single Euro Payments Area) is a system that enables individuals, businesses, and organizations to make electronic payments in euros within the European Union (EU), the European Economic Area (EEA), and a few other European countries.

You can make a SEPA transfer to any European country, including Eurozone countries and other EU member states, including the EEA (Switzerland, Norway, UK). There are 36 members in SEPA, consisting of the 27 member states of the European Union, the four member states of the EEA European Free Trade Association (Iceland, Liechtenstein, Norway and Switzerland), and the United Kingdom. Some microstates participate in the technical schemes: Andorra, Monaco, San Marino, and Vatican City. You can find the complete list of SEPA countries here.

SEPA covers most types of domestic and cross-border payments in euros, including credit transfers, direct debits, and card payments.

SEPA payments are made through a network of banks, payment service providers, and other financial institutions. When a SEPA payment is initiated, the funds are transferred between the sender and recipient’s bank accounts using a standardized format and process.

SEPA transfer should take the same time as a domestic transfer within your country, normally 1 to 2 days and a maximum of 3 working days.

As per regulation, the banks should charge the same for a SEPA transfer as for a domestic transfer.

To make a SEPA payment, you will need to provide your bank with the recipient’s bank account information, including the IBAN (International Bank Account Number) and BIC (Bank Identifier Code). You can then initiate the payment through your bank’s online or mobile banking platform or by visiting a branch in person.

SEPA payments are considered to be secure and reliable. The system uses advanced security measures to protect against fraud and unauthorized access to financial information.

Are there any fees associated with SEPA payments? In general, SEPA payments do not carry additional fees or charges beyond the normal fees that financial institutions may levy for processing electronic payments.

Please a need help !

I Have a blocked account with a german bank (fintiba) a month ago i applied for a student room in a hostel in Germany and now the hostel manager asked give my sepa information which i don’t clearly understand what he is asking for . Can someone please help me ? Bitte

Hi Dennis,

He is asking for your bank account information (IBAN and BIC) so that he can set up a SEPA direct debit (https://banks-germany.com/transfer-money/direct-debit) for your room rent.

However, you won’t have that since Fintiba does not provide a current account (Girokonto), but only blocked account service (https://banks-germany.com/blocked-account-germany). You will have to open a normal bank account (Girokonto) when you arrive in Germany to make regular payments to your hostel. So you will have to tell him that you don’t have a bank account yet, and have to open one when you arrive in Germany. Normally, the manager at the Studentenwerk (Student Union) who takes care of the hostels would understand that foreign students won’t have a bank account. So don’t worry.

Good luck!

Very good info .. thanks