DKB bank is one of the best bank accounts in Germany. Here is a comprehensive English review of the DKB-Cash bank account and hopefully also answer all your questions on how to make the best use of the bank.

About DKB

DKB stands for Deutsche Kredit Bank- a subsidiary of the Bavarian bank headquartered in the German capital Berlin. DKB was founded in 1990 and emerged from the State Bank of the GDR. Today this prestigious bank employs more than 1,000 people who serve more than 3 million customers and thereby endeavour to provide the perfect service and full customer satisfaction. The focus of the performance of the DKB is currently the DKB Cash checking account that is managed for private and freelance clients. For further product portfolio the Bank is also financing real estate and the granting of personal loans.

Summary

DKB Bank

Here is a quick summary of the features of the DKB Bank account.

Free Account

The first current account is free for all customers if a minimum of 700 euros are received per month or for anyone under the age of 28.

Free Visa debit card

A free Visa debit card, which allows for convenient and secure payments with no annual fee and the option for direct debit, as well as payments via smartphone or smartwatch.

Free withdrawal and payment

With the Visa debit card, the ability to withdraw money and make payments worldwide. With active status, it’s also free of charge to use anywhere that accepts Visa.

English App

The DKB app provides switching to the English language and makes banking with DKB more accessible and user-friendly for English speakers.

Free for Students under 28

Free student account up to the age of 28, with a free ISIC card

Read more on Students Account

Free Depot Account

Free deposit and clearing account Fixed order price of 10 € (below €10,000 order) otherwise 25€. Promotional conditions for ETFs and funds

Free VISA debit card (free worldwide withdrawals)

A free DKB VISA debit card is provided along with the DKB account. Most importantly, any cash withdrawal at any VISA ATM is free, irrespective of the country or the currency for Active Customers. Therefore, DKB provides a free VISA credit card with free cash withdrawals worldwide* for Active Customers. When withdrawing from a non-Euro currency, the currency exchange rate is also very fair, so you do not have to worry about the exchange rate eating up your withdrawals.

In case the Visa card is used for purchases, it is also Zero foreign currency transaction charges* for Active Customers when a transaction in a currency other than Euros is made.

DKB Visa Debit Card

Free Visa Debit Card

Free Cash Withdrawal at any ATM Worldwide*

Zero foreign currency transaction charges*

* For Active users

English DKB App

The DKB app (blue app with white writing) offers a convenient feature for English speakers, as it uses the first supported language from the device’s “Language & Region” setting.

This means that if English is set as the first language on your device, the app will automatically display in English. Additionally, users can switch between German and English within the app by making an individual selection in the app’s settings.

Overall, this feature makes banking with DKB more accessible and user-friendly for English speakers.

Free Account for Active Customers

If at least 700 euros per month are received in a current account (individual account or joint account), this current account remains free of charge. If less than 700 euros are received in a month, the account will cost 4.50 euros that month.

The 700 euros do not need to be received in one lump sum but can be made up of multiple transfers.

Additional Account: If, in addition to your existing individual or joint account, you open another individual account in your name or another joint account with the same person, the additional account costs 2.50 euros per month.

Example:

- “Individual account A” with more than 700 euros incoming payment = 0.00 euros

- “Individual account A” with less than 700 euros incoming payment = 4.50 euros

- “Individual account B” (regardless of incoming money) = 2.50 euros per month

Free for under 28 years old

Your first account (single and joint account) is free of charge up to your 28th birthday, regardless of whether you receive 700 euros. Additional checking accounts cost EUR 2.50 per month, as described above.

From your 28th birthday, you should ensure that you receive at least 700 euros a month so that your current account remains free of charge. Otherwise, the account costs 4.50 euros per month.

Online Banking

For all modern customers who want to do their banking via the Internet and can largely do without any instructions, the DKB Bank Account is thoroughly recommended. The DKB Account leaves nothing to be desired and is the most innovative and attractive product and, at the same time, a German bank for the German market.

For non-Residents

With the slogan “The bank that speaks their language” DKB bank also provides service outside Germany and for non-residents. They have become stricter in opening a new bank account recently, it is still possible to have a DKB bank account from outside Germany if you are a German citizen living outside Germany or you are a resident of one of the German-speaking countries (Germany, Austria, Switzerland).

But if you are already a DKB bank account holder, you can still maintain the account once you move out of Germany and become a non-resident. So you can maintain a Euro currency bank account with a worldwide free cash withdrawal and a Euro credit card. The advantages and having a DKB account when living abroad can be found here.

Free Students Account with free ISIC Card.

The DKB current account is an excellent choice for students, as it comes with a complimentary ISIC student ID card. The ISIC card not only grants you access to discounts for one year but also provides recognition and benefits worldwide.

With the ISIC card, you can enjoy discounts on flights, transportation, and leisure activities in over 130 countries, with more than 150,000 offers available. It is the only internationally recognized student ID, providing you with valid proof of student status wherever you go.

The ISIC card is also always at your fingertips with the ISIC app, which allows you to have a virtual card available and offers additional features like saving your favourite discounts and using the map function to find discounts nearby.

Overall, the DKB current account and ISIC student ID card make the perfect combination for students looking for a convenient way to manage their finances and access exclusive benefits and discounts.

Advantages of DKB Account

Free Visa Debit Card: You do get a separate debit card.

Free Cash withdrawals worldwide: It is a perfect account for travellers and ex-pats. Imagine going on a vacation and not having to worry about taking different currencies. Just look for any ATM when you land on the plane and withdraw cash in foreign currency. For ex-pats and foreigners, it is also a perfect account, and you can use your German bank account even in your home country on holidays without having to worry about transferring funds to your home bank account.

Ability to still maintain a German Bank account once you move back home: Since DKB also allows non-residents to maintain an account, and you can still use it when you move back home. Just inform the bank of the change of address and residence, and fill out the form informing them of the change in your tax residency.

Disadvantages of DKB Account

Although this bank account is one of the best banks in Germany, for an objective review of the DKB bank account, it is also important to point out some problems and issues you may have with the account.

Higher entry requirement

DKB is infamous for having high requirement standards for opening an account. Especially if you are a foreigner living in Germany, they will require some convincing before you are able to get an account. So, if you are new to Germany, it is recommended that you do not apply for your first account. There is a high chance of being rejected due to a lack of credit score. You can still apply or provide more documents if you were rejected the first time. Be polite and provide additional documents to prove your creditworthiness. Documents which can help include an employment contract stating you have an unlimited contract and a residence permit with a longer duration also help. If you are looking for an alternative option with an easier requirement, check the N26 account or comdirect.

International Transaction costs (for non-Active members): Standard members are charged 2.20% as a transaction charge for non-euro purchases. Although this is normal, other credit cards do not charge these costs (e.g. TF Bank Mastercard or Free Advanzia Mastercard Gold Credit Card). So if you travel or use online in another currency, you should consider becoming an Active member or applying for another card.

Cash Deposit difficult:Since DKB is an online bank, they have very few branches, mainly in former East Germany. In fact, they do not even advertise the location of those branches on their website. So if you are dealing with cash and looking to deposit cash, you are out of luck unless you live near a DKB bank ATM.

Free Account (€700 deposit)

Free Cash Withdrawal in any ATM using Visa

English DKB App

Free Visa Debit Card

Free Worldwide Payments using Visa

Free Depot Account

Detailed English Instructions on how to open a DKB bank account

Step 1: Open the Online Application

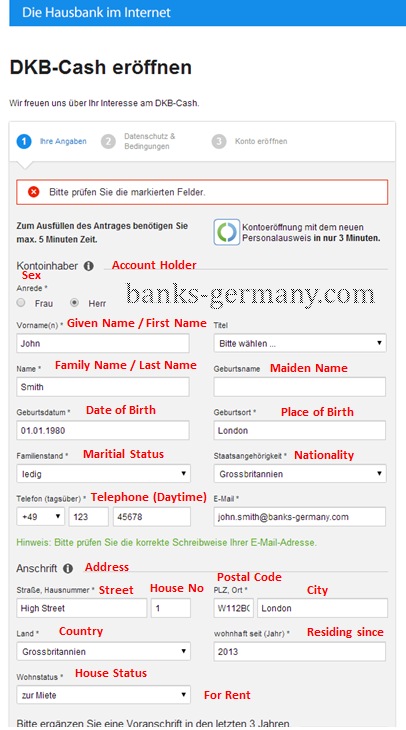

In order to open a DKB bank account, you need to fill up the online application form on the website.

Click on the button at the bottom of the page, which reads “Jetzt DKB-Cash eröffnen” (Open DKB-cash Now) to open the online application form. Fill out the application form online.

You will need the following details as required below. Provide your correct details, as they will be printed on the form, and you cannot change them at a later date. If you have moved address in the last 2 years, then your previous address is also required.

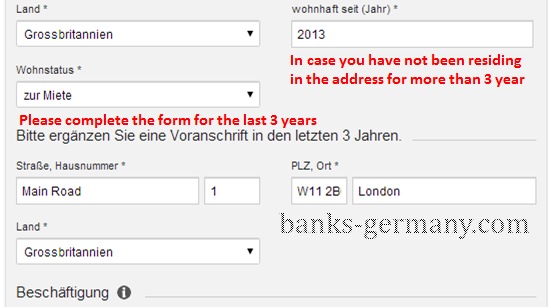

In case you have not resided in the present address for more than 3 years, you will have to provide your previous address.

Step 3 : Provide Employment Details

Enter the details such as Occupation, net monthly salary (after taxes), employed since, Industry

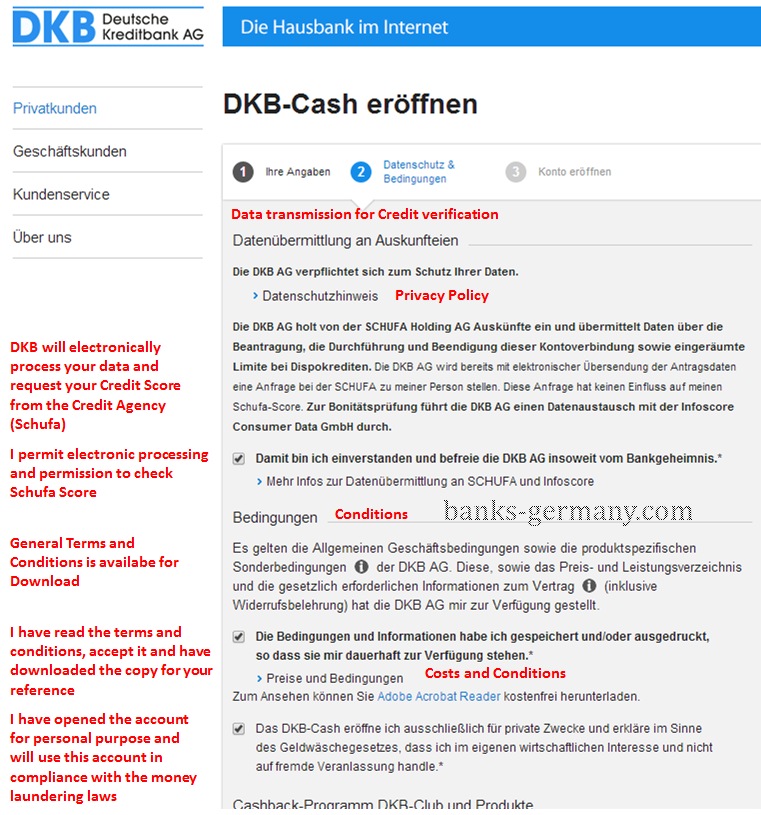

Step 4 : Privacy Policy and Terms

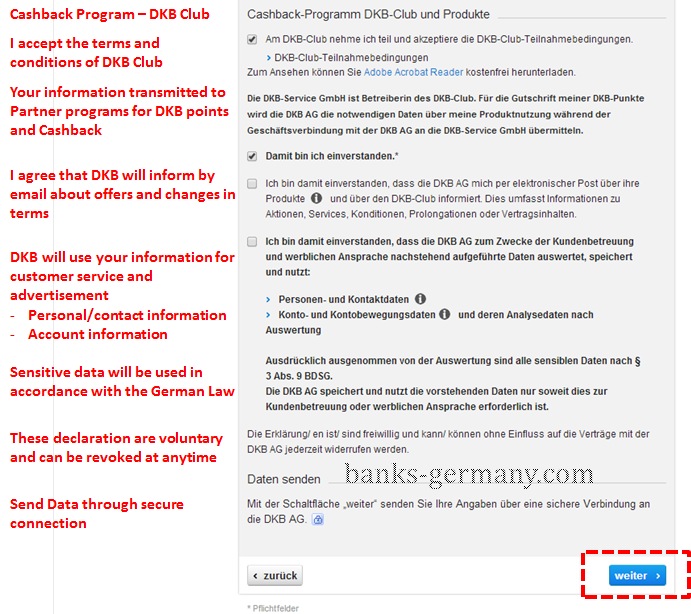

DKB- Club

Agree to the terms and conditions for DKB-Club policy.

Click “weiter” to continue.

Check the boxes agreeing to the privacy policy and terms and condition of the bank account. A rough simple translation of the declaration is provided in the screen shot below.

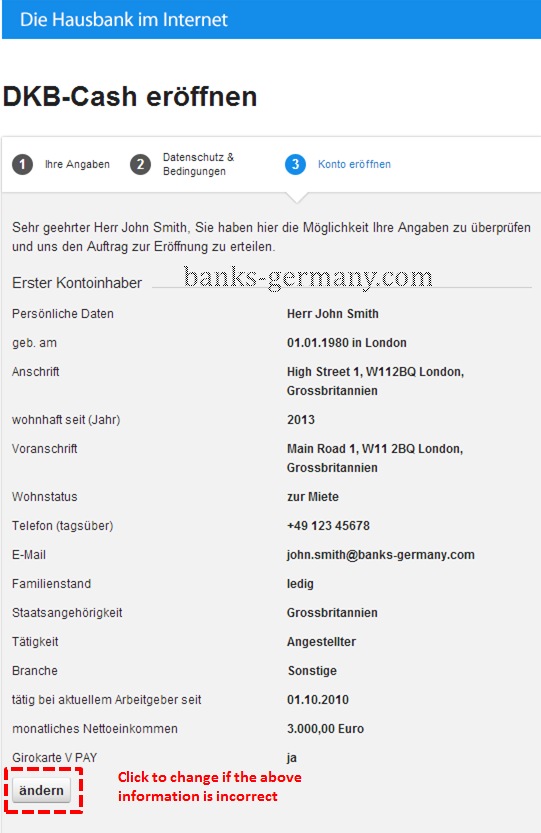

Step 5 : Confirm and Submit

Check if the details entered are correct. If not, click “andern” to change the details.

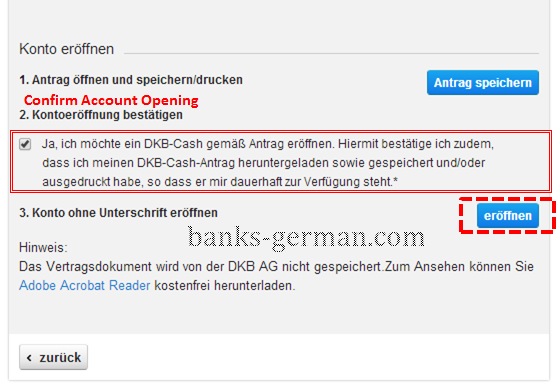

If the details are correct, then download the filled up application form.

Once the application form is generated, the next option is activated. Confirm that you need to open a DKB-Cash account by checking the box. Now click on “eröffnen” to securely submit the application online.

You will then get the last page confirming that the application was submitted.

PostIdent

Step 6 : Documents for PostIdent

Take the filled-up form and the below documents to the local post office for PostIdent.

Document required to open a DKB Bank checking account for German Residents:

- Print out the account application form that was filled out and submitted online. The form can be filled out from the website here and clicking on the button at the bottom of the page, which reads Jetzt DKB-Cash eröffnen (Open DKB-cash Now)

- A valid passport (original) for verification at the local Postoffice for the PostIdent at your local post office

- Proof of current Residence

- Proof of income, such as salary receipts, copy of employment contract, pension grant etc

- For non-EU nationals, include a copy of your resident permit or Visa.

Take the above documents to the nearest post office in person. The clerk at the post office will verify if you are the person as mentioned in the application form and on your passport.

Step 7: Once the clerk checks the documents at the post office, you have to sign the document at the necessary place in front of the clerk. This signature is verified with your signature in your identity documents. After verification, the documents and signature, the forms are put in an envelope and sent to the DKB headquarters to check the account.

Step 8: You will receive an email if further documents are required. These can be sent by email too. Then you will receive a decision by email if your account is opened or not.

If you were successful in opening a DKB bank account, further documents would be sent to you by post in the following days.

Important Note

The clerk at the post office checks if you are a valid person and that the document you sent is verified. The final decision on the opening account is made by DKB bank.

DKB is very selective in opening a new bank account, so if you are a foreigner living in Germany, though not necessary, to facilitate fast processing of your application, it may be advantageous to provide all the documents you can to substantiate your application, such as a good job contract, long term resident permit, good income etc.

Frequently Asked Questions

Yes, the DKB app (blue app with white writing) uses the first supported language from the device’s “Language & Region” setting. This means that if English is set as the first language on your device, the app will automatically display in English. Additionally, users can switch between German and English within the app by making an individual selection in the app’s settings.

Note it’s the DKB app (blue app with white writing) ![]() and not the DKB-Banking App(White background with blue writing).

and not the DKB-Banking App(White background with blue writing).

If you’re using an iOS device, changing the language of the DKB app (blue app with white writing) is simple. Here’s the step-by-step process:

– Go to the settings of your iPhone or iPad

– Scroll down until you see the DKB app.

– Select the app and click on “Language.”

– Choose between German and English

For Android devices running Android 13 or higher, the process is as follows:

– Open the device’s settings.

– Navigate to “System > Language & input > App languages”

– Select the DKB app

– Switch between German and English”

You can deposit cash either in the few DKB cash machines or using Cash in Shop option in one of the branches of REWE, Penny, Real, dm, Rossmann, or other partners (https://www.barzahlen.de).

DKB charges a deposit fee for deposits made with cash in the shop. This amounts to 1.5% of the deposit amount.

1. Generate a barcode: Log in to the Internet banking app and create a barcode. This is available under the Cash in the shop option. Select the desired deposit or withdrawal amount.

2. Visit a partner store: Visit one of over 12,000 Cash partner shops throughout Germany. You can easily find a partner near you using our map. (https://www.barzahlen.de).

3. Withdraw cash or deposit: Get your barcode scanned at the checkout. You can then either deposit (or receive) cash.

For cash in the shop, no purchase the shop is necessary.

If your application is successful, you will receive the following within 14 days:

– an email confirming the account opening

– a letter with your IBAN and access data for banking

– a letter with your new Visa debit card

– the registration data for TAN2go.

After receiving the letter with your IBAN, you may proceed. However, it is recommended to wait until you have received both the access data for banking and the registration data for TAN2go before logging in to banking

with

New customers will receive active status for the first 3 months if they have not had another current account with the DKB in the last 12 months.

Existing customers will retain active status if at least 700 euros are credited to their account for 3 consecutive months, which will be checked monthly by examining the past 3 months.

Whether you have active status is displayed in banking in the financial status.

The 700 euros do not have to be received in one sum but can also be made up of several amounts.

Securities transactions, interest credits, cancellations or chargebacks from the Visa credit card balance do not count as receipts for the active status.

If you are an existing customer, you can regain active status by having at least 700 euros credited to your account for three consecutive months. Therefore, if you lose the Active status, you cannot immediately regain the active account status but have a € 700 deposit for three consecutive months to regain your DKB active status. So be sure not to lose the status; otherwise, you will have to wait for three months before you become an Active member again.