DKB Euro bank account : A Complete guide for opening a non resident bank account in Germany

Check other German Bank accounts for non-residents for more updated information about other banks which offer opening a bank account in Germany for non-residents

Update August 2020: DKB only accepts residents of Germany, Austria or Switzerland. German citizens living in any country can still apply. Others non-residents, you can open a Transferwise Borderless account, or check other non-resident options here.

Wanted to open a Euro bank account from outside Europe? You do not have to be a German resident or even a European resident to open a DKB Bank account in Germany. DKB bank allows you to open a non-resident bank account from outside Germany. In fact DKB bank encourages and provides a simplified process of opening a German bank account as a non-resident.

DKB bank offers customers a free checking bank account for non residents in Euro currency with a free VISA credit card to allow free cash withdrawal from anywhere in the world. It also is among one of the best banks to provide good interest rate for deposits. So if you are looking for a best German Bank account for foreigners to use it on your travel to Europe, or looking to park your money in a safe country earning you a decent interest income, you can consider opening a DKB bank account.

Advantages of non-resident German Euro Bank account

Frequent Travelers – Free VISA Card with worldwide

Are you a frequent flyer and want a VISA card with free cash withdrawals? Are you tired frequent currency conversion during your travel to Europe? DKB – Deutsche Kredit Bank provides a European bank account for non residents in the Euro currency. You can withdraw cash from any ATM free of charge from one of the 1 million VISA supported ATM’s. Globetrotting either in Europe, Asia or South America, you can be sure that you will be able to find a cash machine and withdraw free of charge. The services offered by DKB is also well recommended in many frequent flyer forums.

Free Euro currency bank account

DKB bank offers always free checking account for non-residents in Germany. This no condition account it is a free account, that is , you can still maintain the bank account irrespective of how much balance is left or how often you make a transaction. Since the VISA card allows free withdrawals, you can also use the DKB current account as an online bank account for non residents in Germany. Therefore, if you want to maintain a bank account for transactions in Europe, bank account for non residents by DKB bank is recommended.

German Regulation – Bank assurance

Germany is most stable economy in Europe, therefore a perfect place to park your money. Whats more, regulated by the German government, an deposit insurance of upto €100,000 per person is provided by the German government.

Germany is also well evolved in terms of alternate currency transaction such as Bitcoin. Therefore, if you are considering using a bank account for legal use of internet currency trading in Europe, you can consider opening a EU bank account for non residents.

Tax-free – High interest rate

Ever considered opening an offshore bank account in Germany? The interest and income earned is tax free for a non-resident. You will have to fill appropriate forms stating you are non-resident and asking that no tax be deducted from your account. However, your local tax laws of the country you reside applies.

DKB bank provides 0.90% interest on your VISA account. This is one of the best interest rate offered on an Euro bank account in Germany.

Why should you open a DKB bank account in Germany for non residents?

- Free Euro currency bank account in Europe for non-residents

- Free Euro Credit card for making purchases in Euro or for your travel in Europe

- Free worldwide cash withdrawals – Possibility to withdraw cash in your home country from your DKB bank account

- Tax free in Germany (On completing necessary forms. Home country tax law applicable)

- Deposit guarantee by the German Government

- Decent interest rate on your deposit – If you want to park your funds in a foreign currency

- For more advantages of DKB bank click here.

The only disadvantage is that all the forms will be in German, however this can be easily overcome by using Google translator. You can also find the English translation of the DKB Account opening application form here or in detail below.

How to open a DKB bank account for non-residents in Germany

If you wish to open a DKB bank account online for a non resident from outside Germany, then follow the below steps.

Complete the Online Application

Step 1 : Open the Online Application

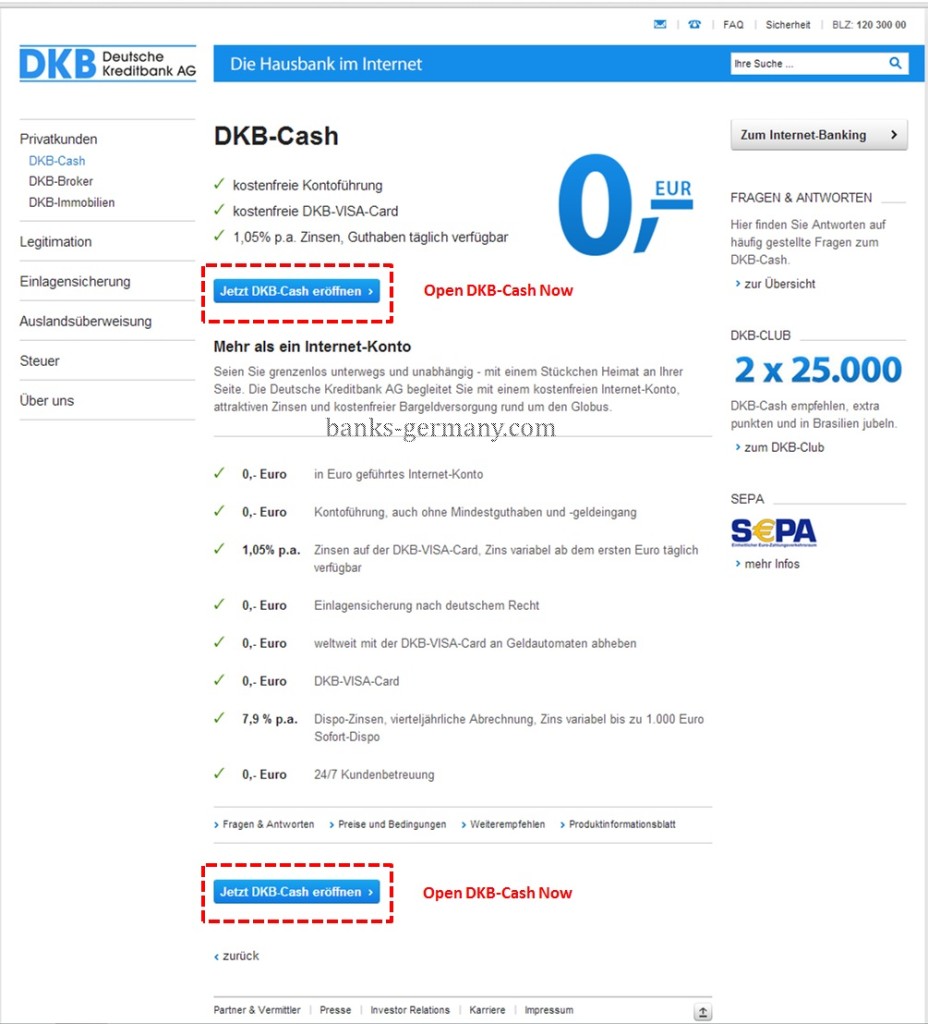

In order to open a DKB bank account, you need to fill up the online application form at the website. CLICK HERE TO OPEN DKB ACCOUNT OPENING FORM

To open a DKB German bank account from USA, click here to go to the DKB USA landing Page

Click on the button at the bottom of the page which reads “Jetzt DKB-Cash eröffnen” (Open DKB-cash Now) to open the online application form. Fill the application form online.

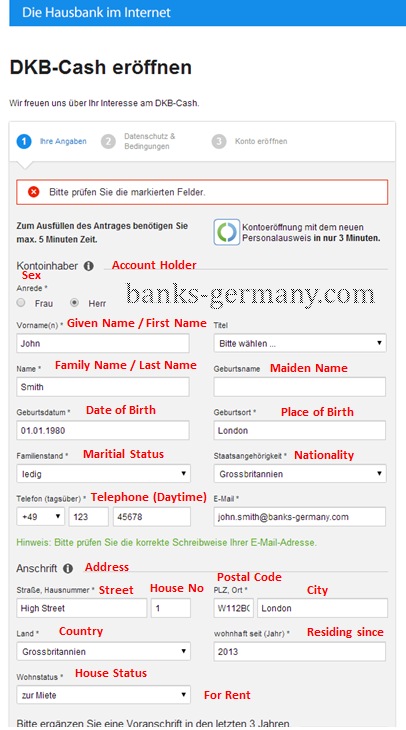

You will require details as required below. Provide your correct details as it will be printed on the form and you cannot change it at a later date. If you had moved address in the last 2 years then your previous address is also required.

Step 2 : Enter your details

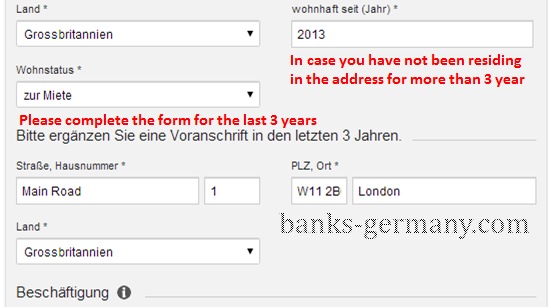

In case you have not resided in the present address for more than 3 years, you will have to provide your previous address.

Step 3 : Provide Employment Details

Enter the details such as Occupation, net monthly salary (after taxes), employed since, Industry

Click “weiter” to continue.

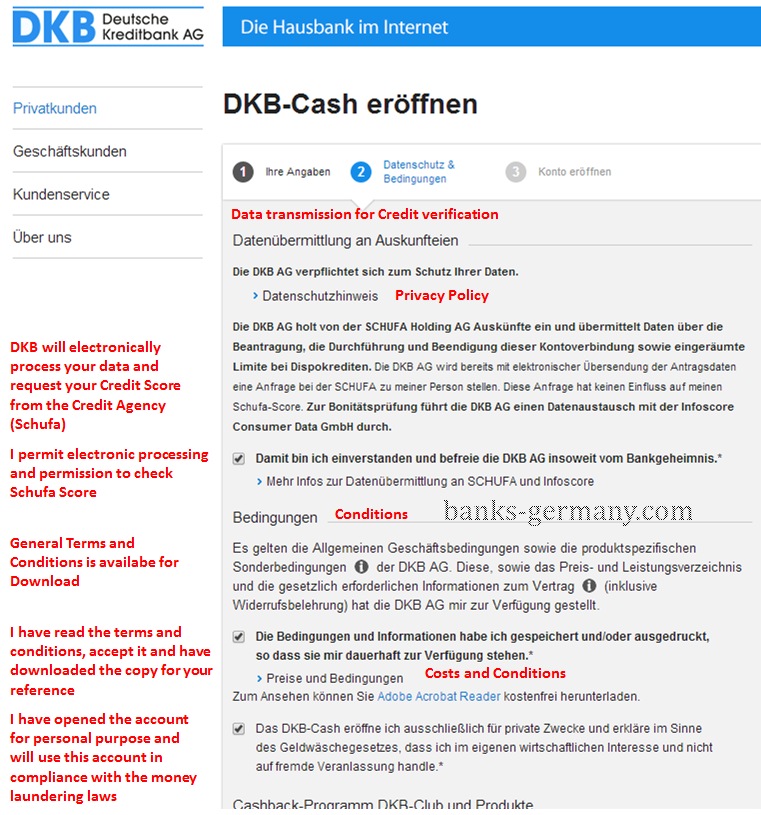

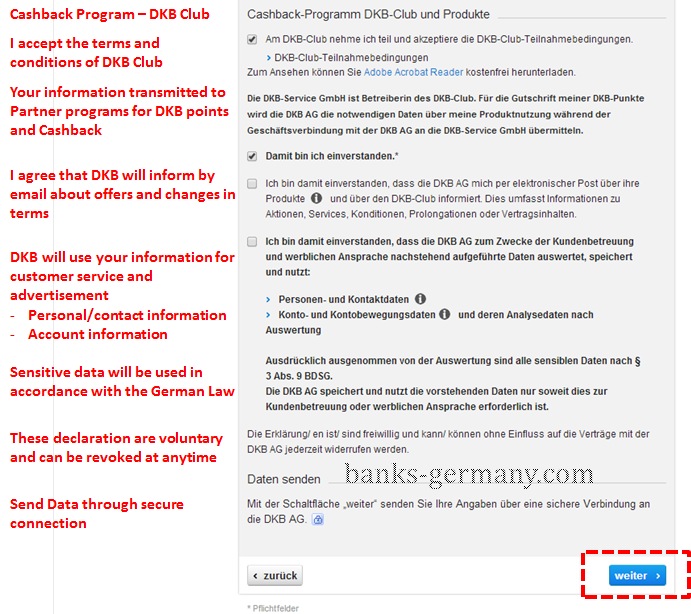

Step 4 : Privacy Policy and Terms

Check the boxes agreeing to the privacy policy and terms and condition of the bank account. A rough simple translation of the declaration is provided in the screen shot below.

DKB- Club

Agree to the terms and conditions for DKB-Club policy.

Click “weiter” to continue.

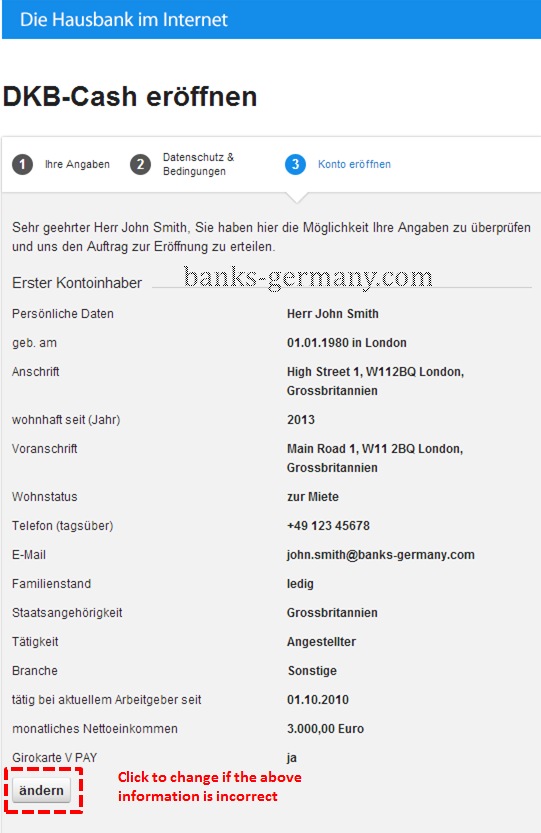

Step 5 : Confirm and Submit

Check if the details entered are correct. If not, click “andern” to change the details.

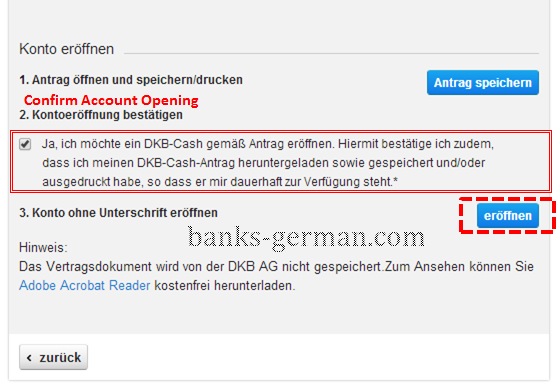

If the details are correct, then download the filled up application form.

Once the application form is generated, the next option is activated. Confirm that you need to open a DKB-Cash account by checking the box. Now click on “eröffnen” to securely submit the application online.

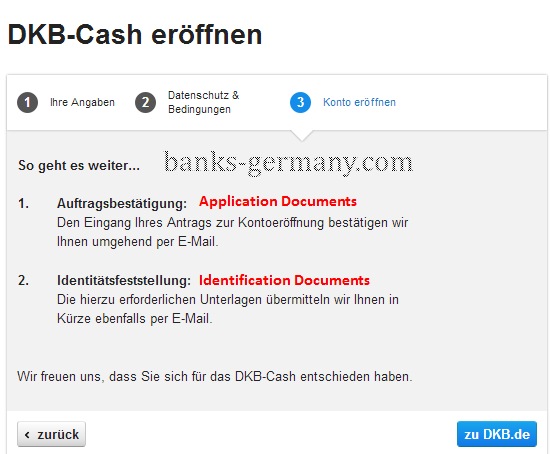

You will then get the last page confirming that the application was submitted.

You will now receive an email with the instruction how to proceed further.

Identification / legitimization

Step 6 : Identification process

You can either open the bank account from outside Germany or during your travel to Germany. Unfortunately, residents of certain countries cannot complete the Identification process without visiting Germany. If you reside in one of the countries provided on the list here, you still open the bank account online, however you will have to visit Germany (see Option 2 below).

Option 1 : Legalizing the documents from outside Germany

If you are resident of a country not on the list , you can open the DKB bank from outside Germany. After completing the application for online, you will receive an confirmation email with the forms. Take the below documents to a lawyer or to a local bank in your local country of residence:

Document required to open a DKB Euro Bank account from abroad:

- Print out of the account application form that was filled and submitted online. You will obtain a copy of this form by email

- A personalized identification form will be sent to you by email (may take couple of days). Make sure to wait for the form as it will have the appropriate reference numbers. In case you do not recieve the form, or in a hurry, you can download the form here.

- a valid identity card or a passport

- a recent proof of residence (less than 12 months old) (such as as, water, electricity bill, bank statement or Address registration at Town hall)

Provide the above documents to a lawyer or employee of a bank for identification. The lawyer or bank employee fills out the form for you depending on the identity card or Passport you provided (Make sure you enter the correct details when you applied online). Review the information in the identification form and the document provided by you, and in the presence of the employee or lawyer sign the document. The Employee or Lawyer then signs the form and the completed form shall send directly to DKB Bank by the lawyer or the bank .

The completed DKB application form should be send to the below address:

DKB AG DKB-Cash/ International 10909 Berlin GermanyIn case this incurs a costs, DKB will refund up to a maximum of €20 on providing evidence of such expenses.

Option 2 : Legalizing the documents when traveling to Germany

In case you are travelling to Germany you can also simplify the process of opening a bank account in Germany for non resident during your travel. Moreover, residents of some countries cannot open a DKB bank account from outside Germany, a list of countries from which you cannot open a DKB account without visiting Germany is provided here.

Take the above documents to the nearest German post office (Deutsche Post AG) in person. Note that you need to apply online before you can go to the Post Office

Document required to open a DKB Bank account when visiting Germany:

- A PostIdent form which you will receive by email after filling up the online form (sometimes takes couple of days). The sample PostIdent DKB form – !SAMPLE (Do not use)!. You will receive an email with this based on your details.

- A valid passport (original) for verification at the German Postoffice for the PostIdent

- A recent proof of residence (less than 12 months old) (such as as, water, electricity bill, bank statement or Address registration at Town hall)

The employee at the post office will verify if you are the person as mentioned in the PostIdent form and on your passport. Once the documents are checked by the clerk at the postoffice, you have to sign the document at the necessary place in front of the clerk. This signature is verified with your signature in your identity documents.

After verification, the documents and signature, the forms are then put in an envelope by the Postoffice and sent to the DKB headquarters free of charge on your behalf. You will receive an acknowledgement copy in hand.

Step 7 : Confirm on the Phone

You will receive an email if further information is required. In some cases you will get a call from a representative asking you the purpose of opening the account. An ideal situation would be moving to Germany in the near future or lot of business travel to Germany etc. It may not be sufficient if you say that you just wanted to park your money in other currency denomination.

Then you will receive a decision by email if your account is opened or not. If you were successful in opening a DKB bank account, further documents will be sent to you by post in the following days.

If your application has been accepted and a DKB bank account opened, further documents will be sent to you by post in the following days.

Step 8: Tax Information

If you are a non-resident in Germany, then the interest earned on the capital in the DKB bank account is not taxed. For this you will have to complete a form after opening the bank account. The tax exemption form is available here. Fill the form and send it by email or fax to DKB-bank.

I am sorry but this is whole load of lies. I am a foreigner and i live in Germany for the past 3 years. I applied to this bank but they do not want to give an account because of “their policies”. Really unfriendly to foreigners.

Hi Shobana,

I supposed you missed the entire point of the article. I am sorry that you were refused an account, but can you please point out which information is a “load of lies”? For your benefit, I am providing some points that you might have missed.

1. DKB is the only bank in Germany which specifically advertises a bank account for non-residents on their website. It is also the only bank in Germany that allows a non-resident to open a bank account without coming to Germany. So would it not be right to say that they encourages non-residents to open a bank account?

2. This article is about DKB bank account for non-residents and you are a resident.

3. Every bank has their policy. It might be that they do not service customers who do not meet their requirements. Being a resident in Germany, you will have a Schufa rating (credit score) which also plays a role. Therefore, a general statement that they are unfriendly to foreigners is incorrect since there are many foreigners who have a bank account with DKB.

It is true that DKB does have certain requirement standard before accepting customers. However, let me repeat, it is the ONLY bank which advertises account for non-residents and allows them to open an account without coming to Germany and this article focuses on that option. Therefore, kindly do not accuse the article of being load of lies as it clearly does not mislead anyone and none of the statements are a lie.

On a separate note, since you are a resident, you can also try ComDirect bank which have more relaxed policy but equally good.

Good Luck

I just Tried opening an account online but it didn’t work. The system notified that they only operate account for resident of Germany Switzerland and Australia.

I’ve tried to open an account online, but I get the answer they deal customers from Germany,Austria& Switzerland is this real? I live in Greece by the way.

Thank you.

Due to the current economic situation, there have been a lot of Greek residents trying to open a bank account outside Greece (specially in Germany). Therefore, the banks in general have limited opening account to Greek nationals who do not reside in Germany in order to stop run-down of Greek banks.

DKB has always been selective of their customers, however it is not entirely true that they only allow customers from German speaking countries. There have been many other nationality who are happy customers of DKB.

I tried to open an account following your instructions and I got the same answer as Manos. Accounts can be opened only by residents of Germany, Austria and Switzerlans. I do not reside in any of the above countries so they declined my application!

So their advertisement is wrong.

I tried to open an account also and it gave me the same message. I guess they changed their policy. Any other bank recommendations?

Unfortunately, I too got a decline message today! I attempted what was prescribed and was denied. I am currently a citizen of United States. This article may be true in its procedures but if they can not approve someone who has a decent salary from a stable country then this should have a notation that they are not accepting applications abroad. I am and extremely disappointed at this non-resident option. I guess this bank is no longer friendly to people abroad unless they come from a German speaking country.

Hi Justin,

US, though being “stable”, requires all banks have to comply with FACTA requirement for US citizens. Therefore, a German bank has to inform the US government of the activity of a US citizen, which, as you can imagine, requires a lot of additional resources for a bank, which they would like to avoid. This not only includes citizens living in US of A but also living in Germany. You can read about the hue and cry by American citizens living in Germany because some banks have refused to work with them.

DKB bank had a separate landing page for USA earlier. So, if anything that has changed, it most likely is the result of FACTA requirement by your country.

i tried to open DKB account after confirming my identification in austria. I am a resident in austria for 4 years. Rencently DKB gave final notice(Reject) about my opening request about DKB bank at first.

I am still confusing about this.

They really would like to help forein residents for opening online bank account in Europe or only in German area or not, i doubted.

I’m Italian and live in Brazil. I’ve tryied to open an account at DKB and process could not be completed, resulting in a screen called Cash Pruefung after all application steps, refusing application.

Stay away from this bank, this is a joke not bank. I contact them to sort few questions before i even try to apply and i got a short answer telling me how i need to translate in german and “Therefore we kindly ask you to re-send your request, enabling us to be of assistance”.

For a bank who is supposedly open to foreigners i find hilarious how they are not able to answer few simple questions in english.

It is a German bank and therefore requires you to communicate in German. Nowhere in the article is it mentioned that you can talk to them in English. In fact, the application form is in German, so you should expect that they provide service only in German. Otherwise, they would have already provided you an English form wouldn’t they.

Under law, a contract has to be in German, and all communication in German for a German bank. They are not allowed to communicate in English for the reason that they are not officially allowed to. The reason being that the communication will be misinterpreted is a language different from the contract.

If you are looking for banks with english service, check here https://banks-germany.com/german-banks-english-service-germany

You could open a bank account in Deutsche-Bank, but you will have to travel to Germany for that and pay monthly fees.

I got the same problem.

“DKB Cash examination

Sorry, we could not match your desire for a DKB Cash in our automatic decision. The necessary conditions for a DKB-Cash are not available according to your specifications.

Please note that we are opening accounts for customers in Germany, Austria and Switzerland.”

How can I solve this problem?

I have read all the responses of the “admin” to the comments. Now I have this question for the admin and need a honest response: das the DKB stay with what I read in the website for non-residents of Germany, living out of EU, not in USA but not in any of the listed countries with some restriction, e.g. To be in Germany before open the account. As per website recommendations, I have the chance to open online account as the bank promises. Now can you tell me that I will not have the same difficulties and “arguments” from the bank that I have read to the previous comments? Thank you.

Hi Tom,

Though I do not completely understand your question, I suppose you are asking if someone living in say UK or Japan or Australia will not have problem opening an account.

The answer simply and honest answer is “I don’t know”. It is up to the bank. Even if you were living in Germany, you may be unsuccessful as it is entirely the prerogative of the bank.

I never claimed to be affiliated with the bank, and have no information to their internal policy, only those that are publicly available. The earlier comments in reply were possible reasons why they might have been. Let me remind again, this article is free information only. If you find it useful then feel free to use it, if not continue your search for a bank which allows non-residents to open an account and maybe inform here if you found something useful for benefit of others.

At the time this article was written (early 2014), it was possible to apply from abroad. If you notice the comments, it was only after Jan 2015 that there were complaints about not being able to open accounts. It seems now it does not possible for everyone.

I hope you checked the update on top of the article.

Good Luck.

Sorry, Admin, but all your recommendations here simply and vividly imply German-speaking countries because writing the following:

“a recent proof of residence (less than 12 months old) (such as as, water, electricity bill, bank statement or Address registration at Town hall)

Provide the above documents to a lawyer or employee of a bank for identification.”

you never mention a (legal) translation of such documents (from apparently local to an applicant “Town hall”, “lawyer” or “bank”) into German which is an entirely new ball game for the huge non-German-speaking world!

Did you checked the update at the top of the page? DKB has changed the policy to only accept residents from German speaking countries (Austria/Switzerland) or German citizens.

Hi,

yesterday I had a phone call with an employee of DKB. I asked her if it is still possible to get a DKB Account. In my case it would be an account for a friend of mine living in Romania. She did NOT tell me that it would not be possible in general. So I will ask the friend of mine just to give it a try. The article here is a great summary of all and thank “Admin” for that. From my perspective it is not a big deal to fill out the form and to “apply” for it to try to get something “for free”.

If DKB will accept it is fine.

If DKB will reject it is up to their decisions and they and the rejected customers have to deal with the consequences in the end.

But not a reason to complain about this.

I am customer at DKB since years and I am very satisfied with their services.

To all consumers having problem with false promotions in which Germany is offering, read between the lines, history is repeating itself. Instead of using the” Reich” they have new advanced Geometric Algorithmic models to discriminate ethical nationalities from the” Pure” citizens!!! Prepare for the collapse, they are already eliminated dividends pay out coming 2016

I am a foreigner, and based on the color of my skin, should have been subjected to discrimination, if what you said were true. But, sorry to ruin your imagination, I have been accepted by the bank and a very happy customer myself for few years now. Banks are there to do business, and it is up to them to decide if want to do business with you and want your money or not. It has nothing to do with discrimination based on your race, but your credit risk. So, please stop complaining about the first world problem and claim to be a victim of racism because you could not get a bank account with a free credit card. This is merely belittling the real victims and discrimination.

Hi,

Is a Swedish citizen eligible for a giro account with your bank?

Thanks for the info.

The website just provides information about different banks, it is not a bank. So, it depends on the banks and if they consider you are credit worthy to let you open the account.

Please I need to open giro account with DKB ,as I have applied for student visa at germany embassy at my home country Iraq. The embassy required prove for financial ability by deposit an amount of 8000 EUR in one of germany banks before issuing my Visa.

please can you help

thank you

I have recently been denied an account with DKB. I am a professional with a job both in the USA and here in Germany. I am a foreigner. The introduction of a residency requirement in order to be able to open a DKB account needs to be understood as a requirement for some kind of credit history here in Germany. Perhaps such a credit history becomes irrelevant in cases where a salary is really substantial (mine is not, so I can only speculate on this). These accounts come with a line of credit, so it makes sense to me that one would need to prove oneself reliable. And for anyone who thinks this is an obnoxious policy, I challenge you to find a country that will open up a line of credit to a foreigner without a whole lot of groundwork first (I’ve been earning a good salary in the US for almost 2 years and am still on a ‘secured credit card’.)

It denied to let me open a bank account. It said:

“DKB Cash examination

Sorry, we could not match your desire for a DKB Cash in our automatic decision. The necessary conditions for a DKB-Cash are not available according to your specifications.

Please note that we are opening accounts for customers in Germany, Austria and Switzerland.”

What to do then?

Thanks!

Hi, Im Lithuanian living in United Kingdom and I would like to open an account in German Bank euro account.

What possibilities I have???

Thank you

“You will have to fill appropriate forms stating you are non-resident and asking that no tax be deducted from your account.”

Can you provide any more information this?

That was a really helpful post. Thanks!

Hi,

I am an Indian Citizen living in Germany.

Can i get a DKB account?

Unfortunately, we could not meet your request for a DKB cash as part of our automatic decision. The necessary conditions for a DKB cash are not available according to your information.

Please note that we only open accounts for customers in Germany, Austria and Switzerland.

Thanks for updating

Im confused with the tax form

https://dok.dkb.de/pdf/erklaer_abst_kest.pdf

Which option under “Angaben zur steuerlichen Veranlagung” should i choose?

I have left germany returned my home country.

Relying on google translate doesn’t help.

If you moved from Germany and no longer a Tax resident in Germany, check the last option: This means you confirm you are not a German tax Resident, and the address you provided is now your new tax residency.

Since you moved from Germany, you have to also provide proof of your move.

So select and provide the following documents

– Deregistration document from the Amt in Germany

– registration to the new tax office in your present country

Dear Sir,

I want to open a Bank account in your bank for business purpose .

My nationality is Indian, i am not living at Germany but i many time visit Germany for Business Purpos.

So Please helps us for opening bank account.

Regards

Arvnd Kumar

+91-6387519962

I am resident in germany with Indian nationality. Can I get a DKB cash account?

Dear,

i am a german citizen based in Dubai (I am “ungemeldet” from Germany and have no address). I want to open a girokonto with DKB, could you please guide me on this matter?

Best regards,

Ayman

Hi,

I live in Germany for last 7 years and permanent resident here with Pakistani passport i still get rejection from DKB without any reason 🙂 . So statement about opening account for all german resident is total lie.

Best Regards,

Faisal

Dear DKB Manager,

My friend has Offshore Company in Hong Kong.The are putting a container of goods in a warehouse value 120,000€ .The warehouse is around Frankfurt am Main , Germany. The Warehouse logistic will do all the delivery to clients in Germany and customers will pay into your DKB bank account.

Can they open a DKB account in Germany as a non resident Company.?

Kindly advise.

Apart Do you have a DKB address in Frankfurt which I can visit and ask for more infomation for my friend in Hong Kong.

Best regrads

Michael Ten